Blogs

An average matter is actually -110, which means you must bet $110 so you can win $100. However, there are says where chances are high tough to have the official additional money including -115 otherwise -120. This is also referred to as the newest vig, the count the brand new sportsbook costs for each bet. Fractional chances are preferred in britain and you can Ireland, and so are the choice for pony racing. In addition to, a lot of sportsbooks in the united states use fractional possibility for futures opportunity. If you bet $a hundred to your a great +one hundred underdog, it is possible to victory $one hundred to own an entire commission away from $two hundred.

- Don’t forget one a playing calculator may also be able to help you figure out how much you’ll rating to have wagering to the specific casino games.

- Every type out of odds features its own positives and negatives, making it important to purchase the kind of possibility one works for you.

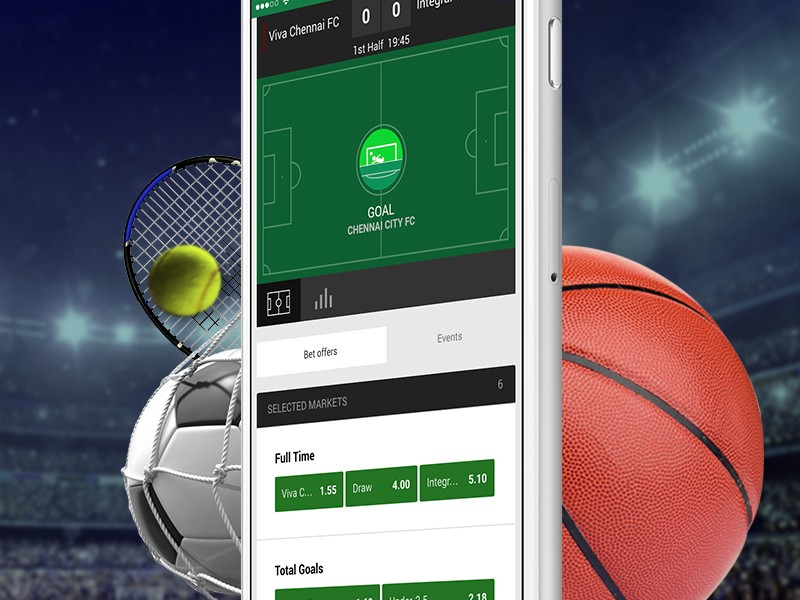

- You can access and make use of him or her on your own smartphone otherwise pill.

- Up coming proliferate the fresh quantitative opportunity with her to get your multiplier.

Stick to the recommendations below to calculate the new payout of one’s parlay choice. Eightfold Wager Calculator – Make use of this equipment to calculate productivity to possess eightfold bets. Within our example, we are going to explore decimal opportunity, which is the most typical structure. We’re going to fool around with pony racing example as this athletics is actually extremely popular to possess Yankee bets considering our very own lookup. In order to by hand determine how much you’ll victory to your an excellent $100 wager, you need to determine if you are betting to your a good favourite (-) or an enthusiastic underdog (+). If you are betting on the an enthusiastic underdog , then possibility have a tendency to show how much might earn if the without a doubt $one hundred.

How can i Calculate Moneyline Parlay Possibility?: bonus codes 888sport

The go back, otherwise Return on your investment is amongst the greatest and most main point here inside betting. It is the contour that shows you how far one of an informed betting software in america will pay aside when the the wager gains. To get the reasonable possibility and real meant possibilities, we advice having fun with our very own no-vig calculator, which you’ll access straight from these pages. In order to find out how which calculator performs in action, we’ve utilized boxing playing such as below. From the Anthony Joshua vs Francis Ngannou battle, Anthony Joshua in order to earn from the TKO is offered at the likelihood of +110 during the DraftKings Sportsbook. Our wager return calculator offers a vital piece of advice – just how much your might earn.

Moneyline Opportunity Calculator

And thus, it preserves go out that have guidelines computations if you are coming down problems that may show expensive inside the wagering. Parlay hand calculators are accustomed to assess the potential payment out of an excellent parlay wager, that is a variety of choice where numerous wagers is shared to the a single bet. This can be done that have pony racing from the bonus codes 888sport merging the results of several races for the one wager. However, it’s vital that you observe that parlay wagers is going to be high-risk, because the all of the individual wagers should be proper to victory the new wager. It’s always a good suggestion doing your research and make told conclusion prior to position any bets. Use our For each Way Bet Calculator to help you simulate prospective profits to possess EW bets place that have Web sites wagering sites or rushing betting shops.

Hold Calculator: How much Perform Sportsbooks Create On every Wager?

Furthermore why an income tax calculator including the one in it book is amazingly handy. No, lottery earnings and sports betting winnings aren’t slightly a similar. That it Colorado income tax calculator may well not reflect which exclusion. Sure, the condition of Texas taxation all the betting payouts from people betting activity of every matter with the exception of lotto earnings from $5,100 otherwise reduced.

Ideas on how to Convert An enthusiastic Meant Chances To Quantitative Odds

Should your pony closes 3rd otherwise bad, then you’ve missing your place choice. Win – You’re making one bet on a horse to finish very first. In case your pony gains, you gather everything you wagered plus your winnings.

Extremely on line gaming hand calculators are there to reduce out one fret and you can issue, however, this one is quite easy to check out. If the indeed there’s a dead Temperatures, next all of the wagers spend during the 1 / 2 of the risk to help you the full Carrying out Speed . This is a properly-dependent Rule one applies to horse racing gaming. Try to enter the proper fractions in the Set Words package too. We’ll have more about in the an extra, however when using our horse wager calculator for each way you’ll normally enter sometimes a quarter or a fifth here. Those individuals would be the portions out of outright earn prices one apply at bets on the recreation out of kings.

By using the Program Choice Calculator: One step

Yankee bet productivity calculator – Should you decide become you to definitely alternatives short of the five needed for a Canadian, which calculator work out your productivity. The new yankee are a less costly, much safer choice you to include merely eleven bets. The new effective tax rate ‘s the real payment you only pay immediately after bringing the simple deduction or any other you can write-offs. The official tax rate inside the Virginia selections of 2% to help you 5.75%, which is the speed your gambling profits is actually taxed. It’s important to imagine betting payouts while preparing your taxes since the those people payouts, when put into your yearly earnings, you’ll disperse you to your a top tax class.

However, there are some standards and you can limitations that you ought to become conscious of. Your payouts has reached minimum 3 hundred minutes the level of their choice. In order to estimate your taxable income, you will want to deduct their alterations so you can income, such education loan attention otherwise IRA contributions, from the revenues. You will need so you can deduct the standard deduction or itemized write-offs from your own adjusted gross income.