Asset-built credit compared to. cash-move financing.

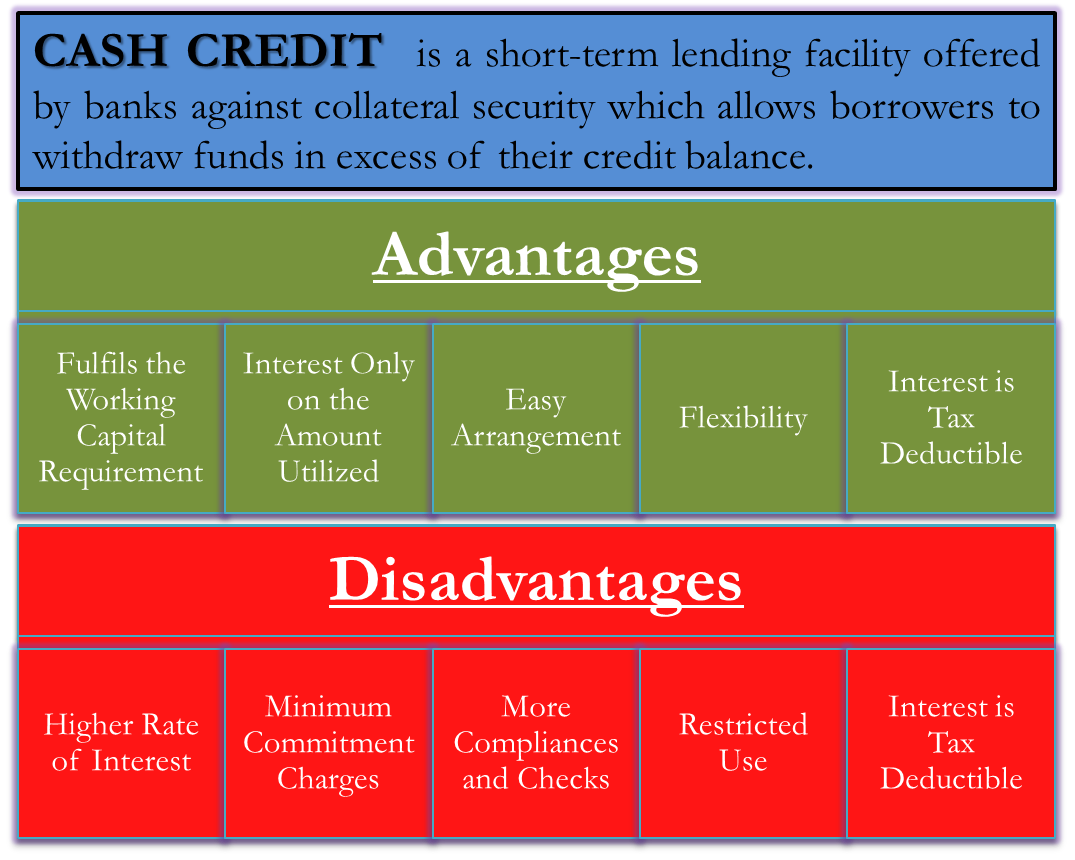

When comparing advantage-situated credit to cash-disperse financing, it is essential to understand the number one differences between this type of resource choice. Asset-situated credit is targeted on the worth of the brand new security you to definitely a beneficial company can provide, such as for example index, equipment, otherwise account receivable. This type of money is specially good for firms that keeps tall bodily assets but might not have a robust income.

While doing so, cashflow lending evaluates good businesses coming bucks circulates once the main conditions on the financing. Loan providers look at the organizations earlier in the day and estimated cashflow statements to evaluate its ability to pay the loan. Such lending is much more right for people with good and foreseeable dollars streams however, fewer actual possessions to utilize once the guarantee.

The possibility between asset-created credit and cash-move credit hinges on the particular need and things of your business. In the event the a friends possess beneficial property however, face cashflow demands, asset-dependent lending can offer a feasible provider. On the other hand, getting organizations which have solid dollars streams however, limited property, cash-disperse credit may possibly provide a compatible brand of money. One another choice possess the deserves and you can possible downsides, necessitating a mindful research to search for the top fit for the newest business’s financial strategy.

Asset-centered investment may come in many different size and shapes. For this reason, the way to determine whether a fund service is reasonable for your business is to lookup and get issues before you could get one brand new financing, personal line of credit, or payday loan.

Earliest, factors to consider your company find the money for use more currency. When you’re sure you might would this new indebtedness and the installment agenda that involves, you will want to then gauge the threats, advantages, and you will costs. In the long run, make sure to research rates and you may evaluate organization financing options. Interested in asset-centered financing and how your business might benefit from this form regarding money services? Find out more about profile receivable resource right here.

How can you be eligible for house-centered financing?

Being qualified getting investment-founded credit generally relies on the standard and cost of guarantee your company can provide. Lenders have a tendency to gauge the value of the brand new assets you propose to help you explore due to the fact equity, such accounts receivable, catalog, home, or gadgets, to determine if they qualify having a secured asset-centered mortgage. Along with collateral, lenders may think about your organization’s credit score, regardless of if quicker focus is placed on the fico scores compared to traditional loans.

This new monetary health of one’s providers, displayed using earnings and you will profitability, may also be analyzed to make sure your organization is also support the payments. Lastly, having a clear and you can perfect list of possessions, as well as valuation permits otherwise monetary statements, is facilitate the certification process.

What is actually a good example of asset-situated lending?

Imagine a production organization leverages $140,000 worth of their index given that security in order to safe that loan. Using investment-mainly based credit, the organization receives financing regarding $70,000 (50% of the property value the inventory) through providing their current collection off raw materials and you can done items since safety. This increase off money enables the business to invest in the extra raw materials expected, defense labor prices for enhanced production, and eventually satisfy the offer.

In the event that, however, the organization spends their membership receivable given that equity, it does safe up to to 80% (otherwise $112,000) of one’s value of its marketable bonds.

Is it difficult to get financing owing to investment-centered credit?

Acquiring financing owing to resource-oriented lending should be relatively more relaxing for firms that will most likely not be eligible for traditional finance on account of earnings facts, a short time in operation, or quicker-than-primary credit scores. The ease from availableness primarily relies on the value and online payday loan Delaware you will high quality of your security you could potentially promote. Should your business has property which might be filled with worthy of, with ease liquidated, and you may meet up with the lender’s criteria, you may have a powerful risk of securing investment-established funding. Remember, even when, that each and every bank features its own selection of criteria, therefore the processes you’ll cover in depth examination of the possessions. Therefore, when you find yourself advantage-mainly based financing can offer a viable approach to money, the ease of obtaining such as finance depends somewhat on your own business’s specific monetary and you will advantage disease.