Vidhi S. are a real house lover. Their unique blogs walks clients step-by-action from selling processes, regarding pre-acceptance to closure. Within her free time, discover her engrossed inside a novel.

Megha M. is an adept blogs editor better-qualified on ins and outs out of American ics and you may financial fashion. In her own sparetime, she excels because the a flexible movies artist and you can public speaker.

Hard currency fund provide property owners with reduced entry to asset-founded resource. Within mortgage types of, a debtor is provided with real assets while the cover into financing. Lenders render wide variety ranging from 65% and you will 75% of the value of brand new covered asset.

Personal money lenders offer hard currency loans as the a form of short-label financing the real deal estate investment and flip plans. These fund enable it to be consumers for taking advantage of go out-sensitive and painful market opportunities.

In place of conventional loans from banks, tough currency fund prioritize property value over debtor creditworthiness. This will make them accessible to people that might not qualify for antique financing.

- The hard currency credit globe has experienced an astounding 20% annual rate of growth over the past 5 years.

- The modern industry sized tough money loans is higher than $several mil.

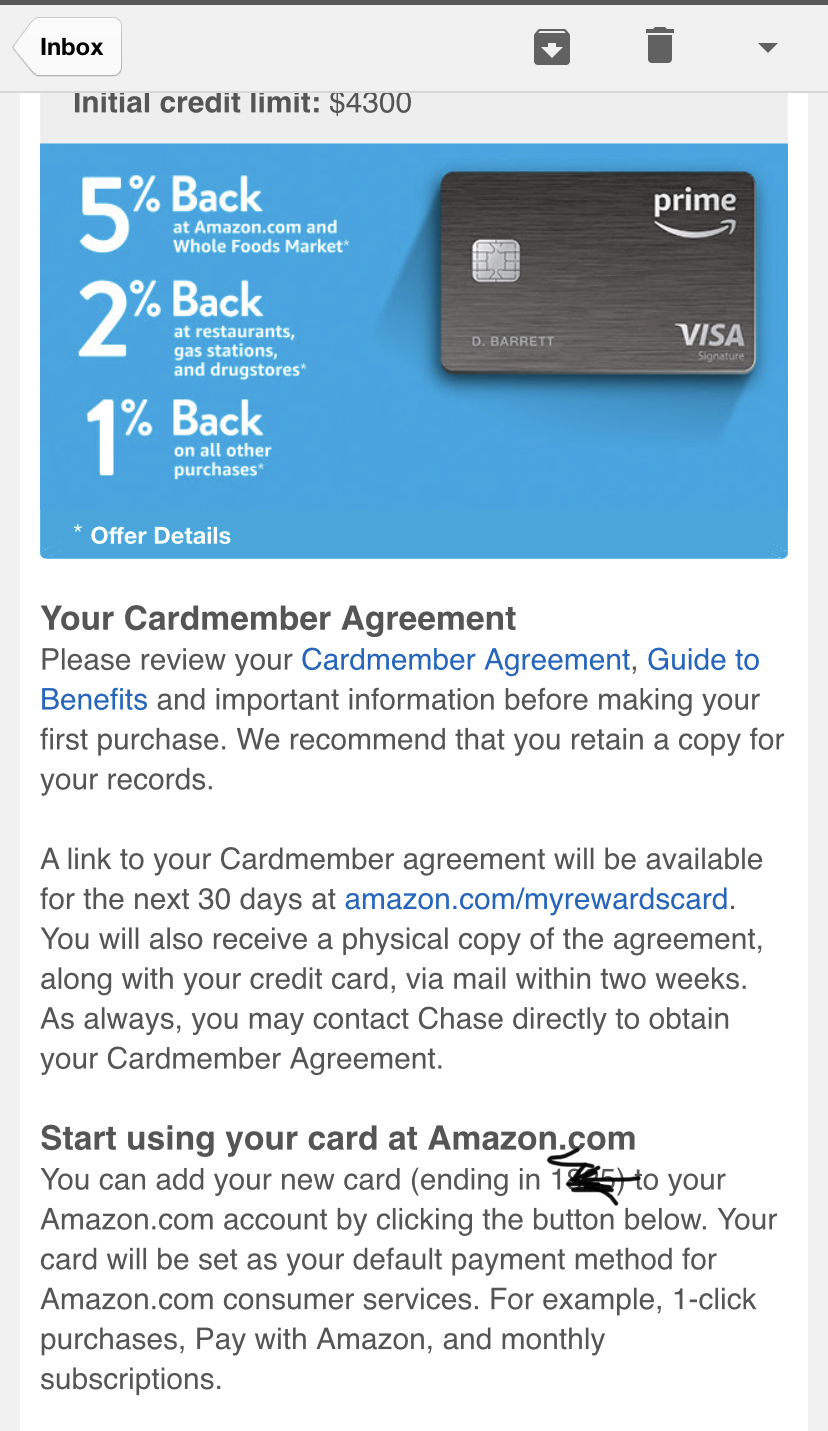

- Difficult currency lenders offer financing between 65% and you can 75% of your own value of the fresh safeguarded resource. The debtor need to create a twenty-five%35% down payment to your mortgage.

1. Residents Facing Foreclosures

Property owners against foreclosure can use difficult-money loans due to the fact a past make use of prevent losing their house. House security can help all of them repay earlier-due payments and steer clear of foreclosure.

A home traders will benefit out of tough-currency loans as well as their small approval techniques. They normally use these types of financing to pay for sales, make home improvements, and other short-term requires.

Family flippers buy the homes with the want to enhance them immediately after which offer them to possess a return. Possessions flippers can buy domiciles fast to have renovation.

Hard money loans try an obtainable selection for individuals who’re struggling to fulfill the get an easy payday loan Rockville AL strict criteria away from normal loan providers and you can would n’t have good credit.

Benefits of Tough Currency Loans

- Small Funding and you will Acceptance: Unlike old-fashioned fund, tough currency fund promote brief funding, recognition, and you may access to cash.

- Easier Underwriting Techniques: Private currency loan providers approve fund easily while they focus on property more than new borrower’s borrowing, earnings, otherwise debt rates.

- Flexibility: To help you way more directly match financing so you can good borrower’s standards, lenders and you will consumers tend to agree on versatile terms and conditions.

- Extremely right for short-term expenditures: Assets flippers exactly who plan to redesign and you may resell the actual property made use of because the shelter towards the loan can get make an application for difficult currency finance.

Cons regarding Difficult Money Finance

- Regulating Limitations: New regulating limits difficult currency money suffer from from additional state and federal regulations try you to definitely big disadvantage ones.

Options for Hard Money Loans

Difficult money finance allow simple investment for various explanations. Yet not, most of the time, such loans features big bills. These types of loans encourage borrowers to explore alternatives for tough money financing:

Conventional bank loans can replace hard currency fund having down notice prices. not, taking antique funding mode fulfilling rigid conditions such consistent earnings, good credit, and working which have enough time recognition techniques.

Such as for example difficult currency loan providers, personal money loan providers provide money having relatively lenient conditions. But not, they could use relatively high interest rates. Lenders have a tendency to slow down the rates of interest because of their customer base.

Using P2P credit systems, conventional economic intermediaries is precluded by assisting direct contact ranging from dealers and you will consumers. Even if P2P financing can offer straight down rates of interest significantly, they appear to restricts what amount of accessible financing.

People which have significant equity within their belongings will enjoy this new versatile credit alternatives provided by HELOCs. Such credit lines give cash on request in the interest rates reduced pricey than simply tough money loans.

Industrial link money are a good possibilities for their requirements and rates. Constantly, business lenders bring these money. Bridge funds help you get brief-title financial support while you are purchasing a special assets or refinancing.

Whether or not credit cards can offer small-name money for short-level ventures, its higher rates of interest make sure they are the wrong having high-level duties.

Summary

A house flippers, people, and you may borrowers wanting fast access to invest in can find a good valuable financial support solution inside the hard currency funds. It does exceed this new tight conditions off regular lenders. Whenever you are advantageous having capitalizing on big date-sensitive opportunities, the more will set you back and risks linked to such financing need mindful believe.

The purpose using this website were to give subscribers that have a keen in-depth understanding of hard currency fund so they really could make smart possibilities who after that their financial objectives.

But not, the genuine convenience of hard-currency money has large rates and you can big down repayments. It’s important to weighing advantages and you will cons ahead of committing.