He including didn’t understand how difficult it will be to save in the regards to the new contract, because the guy failed to understand how much works the house carry out you desire. There’s absolutely no requirement one a house inspector look at the home just before an agreement-for-deed contract is signed. When Harbour informed your the guy necessary to score insurance coverage, he states, the insurance coverage team already been sending him complications with our home you to the guy didn’t even understand stayed-one file he exhibited myself, particularly, informed him you to his rake board, which is an article of wood close his eaves, is appearing break down.

And second, Satter told you, all these businesses are aggressively centering on communities where customers battle which have borrowing because of previous predatory lending techniques, like those that fueled the subprime-financial crisis

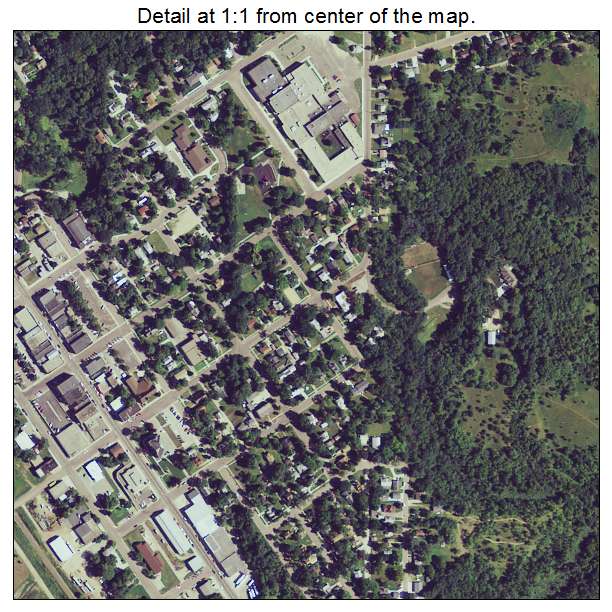

It map, within the Court Aid problem, suggests this new racial structure of the places where Harbour characteristics are located in one to Atlanta county. (Atlanta Courtroom Support Area)

There is nothing naturally completely wrong having deal-for-action preparations, states Satter, whoever dad, Mark Satter, aided plan out il citizens resistant to the practice about 1950s. It’s still easy for vendors who are not banks to finance services in a reasonable ways, she said. A san francisco bay area initiate-right up entitled Divvy, such as, are comparison a rental-to-own design in Kansas and Georgia that delivers manage-become customers some guarantee in the home, though they standard to your money. But there’s two grounds these types of offer-for-deed arrangements look eg unjust, Satter said. Basic, the brand new property a large number of these businesses purchase have terrible condition-of numerous had been bare for decades just before getting bought, in lieu of new belongings ended up installment loan Reno selling for package for deed throughout the 1950s, which regularly was discontinued of the white people fleeing in order to new suburbs. Fixer-uppers create difficult having do-feel people meet up with all of the regards to its contracts, given that houses you want so much really works.

The latest credit uck, enabling financial institutions to give subprime financing or other financial products so you’re able to those who if you don’t may not have entry to lenders

In a few suggests, brand new concentration of price-for-action properties from inside the Dark colored neighborhoods try a logical outgrowth away from what happened inside the homes boom-and-bust. Commonly, these materials energized exorbitantly higher rates of interest and you will directed African People in the us. You to definitely study discovered that anywhere between 2004 and you may 2007, African People in the us was 105 percent apt to be than white buyers in order to features higher-pricing mortgage loans getting family sales, whether or not managing to have credit history or any other exposure issues. When each one of these someone lost their homes, banking institutions grabbed them more than. Individuals who failed to sell from the auction-tend to those who work in mainly Dark colored communities in which those with capital don’t must wade-wound up on profile from Fannie mae, which had covered the mortgage mortgage. (These are thus-called REO, otherwise real-home possessed residential property, once the financial owned all of them once failing continually to sell them from the a foreclosures market.) Federal national mortgage association upcoming offered this type of residential property up at affordable prices to traders who wished to buy them, such Harbour.

However, Legal Help alleges you to Harbour’s presence in Atlanta’s Dark colored areas is over happenstance. By choosing to only pick belongings of Fannie mae, brand new suit claims, Harbour wound up with property from inside the areas that knowledgeable the biggest number of foreclosures, which are the exact same groups directed of the subprime-mortgage brokers-groups off colour. Possibly the Fannie mae house Harbour ordered was indeed within the decidedly African Western communities, new lawsuit alleges. The common racial composition of one’s census tracts inside the Fulton and DeKalb counties, where Harbour bought, try over 86 percent African american. Most other consumers in the same areas one to bought Fannie mae REO characteristics sold in census tracts that have been 71 % Ebony, new lawsuit states. Harbour and directed the products it makes at African People in the us, the fresh lawsuit contends. It did not sector the offer-for-deed arrangements within the newspapers, to your broadcast, or on television for the Atlanta, the newest match states. Alternatively, Harbour create cues from inside the Ebony neighborhoods and you may provided recommendation incentives, a habit and therefore, the latest suit alleges, meant it was primarily African Us americans whom observed Harbour’s render.