Twice as of numerous pay day loan readers work at Walmart than the the second most commonly known business, Kaiser

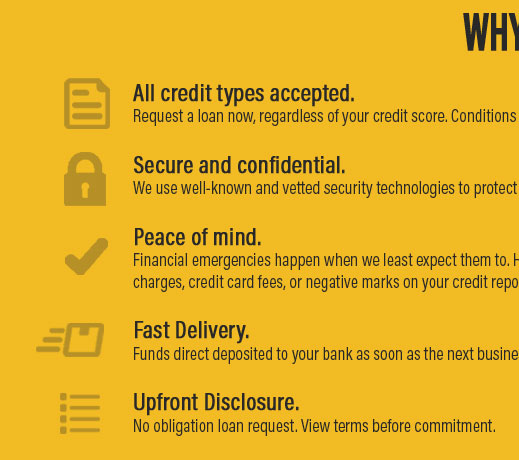

Payday loan are used by those who you prefer money quick, whom usually have no other way from borrowing money to pay for an urgent bills. The benefit of these kinds of fund is because they enable you to get to know your instantaneous obligations. The danger, however, is that you try taking on obligations and you may incurring upcoming debt one to wanted future income to satisfy.

In this article, we’ll get acquainted with Find Out More use position of people who take on pay day funds. Manage he has got perform that will enable them to pay the fresh new money in a timely fashion otherwise will they be cornering themselves towards the some financial obligation with no earnings so you’re able to actually ever pay off the brand new fund?

At LendUp, we offer finance to those to fund unexpected expenditures or whenever they want the money punctual. Because of all of our many years of underwriting loans and working with the help of our people, we know a lot concerning economic records of your mortgage users.

Within studies, we will comment the information towards employment services out of People in the us who seek out payday loan. How many those who check out payday loans has actually operate? Will they be functioning full-some time and in which do they work?

I learned that brand new overwhelming most of payday loan receiver (81.2%) features regular operate. When you add the level of recipients that really work part-day or are already retired, one to is the reason well over 90% regarding users. Mostly, cash advance recipients operate in conversion, office, and you can healthcare help. The best boss away from LendUp profiles exactly who seek a pay-day financing is Walmart, followed closely by Kaiser, Target and you may Domestic Depot.

Included in all of our application for the loan process, we query individuals to say their work updates and you will newest workplace. For it research, i analyzed funds off 2017 in order to 2020 observe the absolute most popular a job position, markets and you may businesses. The information and knowledge try regarding states in which LendUp already operates (WI, MO, Colorado, Los angeles, MS, TN, CA) plus a lot more claims where we prior to now produced loans (IL, KS, La, MN, Okay, Or, WA, WY). In relation to the most popular businesses from payday loans recipients, these details place have a tendency to reflect the largest companies within our biggest markets, such California.

81.2% of all the payday loans receiver toward LendUp provides full-go out employment, for example they should has actually income arriving at pay its costs. More commonly, anyone explore cash advance to cover timing mismatch of experiencing an amount coming in through to the income comes to fund it. For people who create individuals who is actually area-day working, resigned, otherwise mind-used to people who have complete-go out employment, you account for 96.1% out-of pay day loan recipients. Just step 1.2% out-of pay day loan readers are classified as unemployed.

To start, why don’t we go through the employment condition of people that rating pay-day funds through LendUp

Included in the software procedure, LendUp cash advance users report details about their community out-of work. Next graph reduces financing readers because of the industry:

The most used world having looking for a payday loan try sales associated. This may include merchandising specialists otherwise sales people concentrating on an effective fee with an unpredictable spend agenda. The next most common marketplace is someone involved in work environment and you can management. From notice, the next most typical category is actually healthcare associated.

Lastly, why don’t we go through the enterprises with the most payday loans receiver. As stated earlier, keep in mind that this data reflects the utilization base when you look at the places where LendUp operates which and big businesses will naturally appear more often on below number:

Walmart, the largest company in the united states, is the number boss from pay day loan recipients through LendUp. Record is dominated by shopping businesses, as well as health care, education, and you will regulators.

Inside data, we’ve got found that the bulk off payday loan recipients try functioning regular. Despite earning a typical money, costs show up that folks don’t have the savings account balances to cover. A few of these anyone work with college or university, hospitals, and the areas which have considering crucial qualities on pandemic. Anybody rating payday loans to pay for urgent costs, and for of many Americans, such on the internet funds will be just source of investment offered throughout the days of crisis otherwise whenever economic demands exceed readily available financing.