TD Lender isnt participating in the fresh SBA’s Head Debtor Forgiveness webpage. Among the prominent PPP loan providers, you will find a powerful digital PPP forgiveness webpage in place you to will bring a sleek process for our people.

TD is actually after the current program requirements and you may SBA guidance to your PPP. We’ll always maintain our very own users advised if any legislative change are created to the newest PPP otherwise even more procedure SBA pointers try received.

In preparation to own implementing, it is very important dictate when you will be permitted implement and when the right time is actually for you to pertain. Keep in mind their PPP financing payments is briefly deferred when you look at the accordance into the terms of the application. When you get forgiveness, you are going to need to start making payments toward people unforgiven part of the mortgage following SBA remits your forgiveness total us or tells us that your loan isnt eligible to forgiveness. Please note, focus accrues into the deferral months. New SBA will include accumulated attention on the one forgiven part of your loan after they remit commission of your own forgiveness amount to TD Financial. If the your bank account will get two months delinquent, TD will begin charge off process on your own financing, that’ll perception your capability locate company lending from the upcoming.

Certified expenditures is payroll costs (lowest sixty% off proceeds) and you will low-payroll costs (up to forty% of continues). To have a full set of the qualified expenses, also services which were extra within the Monetary Aid Work, or any other items that ount, please visit

Distribution a good forgiveness application before paying your loan continues towards the accredited expenses you may lower installment loans Vermont your forgiveness amount. We could only complete your forgiveness demand shortly after into SBA. We encourage one consult your accountant, courtroom or monetary advisers before you apply.

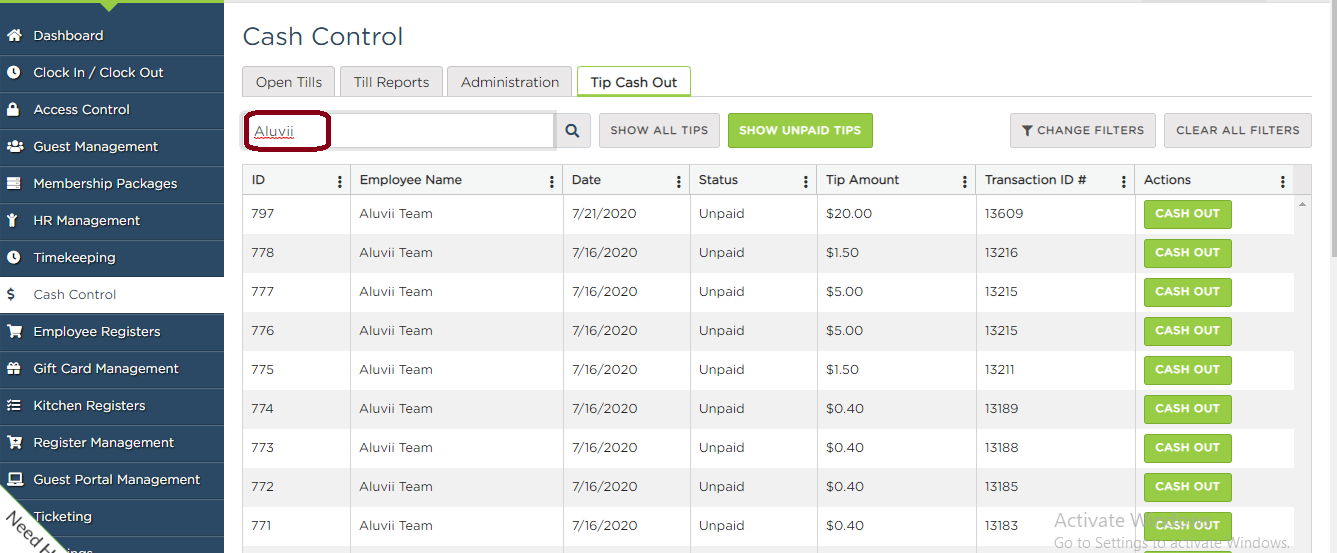

Merely a holder otherwise authorized signer on the first otherwise next draw PPP software can put on to own forgiveness. Organization Advisors (such as for example CPAs, Attorneys, etcetera.) or any other non-manager personnel not on the PPP software will be unable to log in to the website.

If for example the company has already established the adopting the, please contact TD Lender at (855) 847-0664 Meters-F nine In the morning-5 PM, before you apply to ensure control data is advanced:

Your loan proceeds should have become invested (otherwise obtain, per system guidance) inside your protected period, which starts towards day their PPP mortgage is actually financed

- Upcoming purchases of company, that it must be authorized by the SBA beforehand that can wanted an escrow regarding PPP mortgage finance

- Loss of a holder, delight be prepared to render a passing certification and you may associated courtroom documents showing short term or permanent change in possession

- Personal bankruptcy

The loan proceeds should have become spent (or sustained, for each and every program recommendations) in your secure period, which starts to your day their PPP loan are financed

- Payroll expenses (at the least sixty%): Salaries, earnings, tips or earnings (capped in the $100,000 to your an annualized basis for every single employee); staff benefits (i.elizabeth., vacation/unwell spend, healthcare/retirement benefits, life/vision/disability/dental insurance plans); and you can state and you will local taxes examined into the compensation.

Simply loan continues spent on qualified costs need forgiveness

That it current email address may come of donotreply- and certainly will include a relationship to new Webpage. Delight be sure to look at the box to make sure you never miss the email address. The links included in the email address really should not be shared with others; not absolutely all consumers have a similar access date toward on the internet application.

Consumers that the second mark PPP loan higher than $150,000 need to get forgiveness of its very first draw PPP mortgage just before he could be eligible to submit an application for forgiveness away from its second draw PPP mortgage.