Knowledge Prefab Home

Prefab residential property, short getting prefabricated homes, was property that will be are manufactured out-of-webpages then directed on the final spot to getting put together. These land manufactured when you look at the managed facility surroundings, which can make them faster to create than antique land. Prefab land ranges popular of progressive in order to antique and you may are designed to suit the new homeowner’s preferencesmon sorts of prefab belongings were standard home, are formulated residential property, and you can smaller house. Prefab home are going to be Single Family unit members Land , Attachment Dwelling Tools otherwise Multi-Family unit members Belongings. Another type of system MHAdvantage aka CrossMods Belongings supply the homeowner the purchase price savings off prefab property however, qualifies with the appraised cherished off webpages founded home.

Great things about Prefab Property

Prefab residential property are typically much more costs-active than antique house as a result of the sleek structure processes. On the other hand, they are often opportunity-effective, which can end up in all the way down power bills over time. Prefab residential property try customizable, allowing homeowners so you’re able to personalize the liveable space predicated on its tastes. they are browse around this site eco-friendly, because they make shorter waste through the construction versus conventional house. Also, prefab belongings are less to construct, and that means you is move in at some point and commence viewing your new house less.

Resource Options for Prefab Residential property

In terms of money prefab belongings, there are many available options to consider. The most common a way to loans a prefab house in California were conventional mortgage loans, signature loans, and you may construction fund geared to prefab residential property. Conventional mortgage loans work having prefab land one to fulfill practical building codes. Personal loans offer quick access to funds just in case you get maybe not qualify for conventional mortgage loans. Framework money specifically made to have prefab belongings provide funding for the home and its set-up.

Loans and you can Home loan Factors

Whenever financing the prefab family inside Ca, believe some other mortgage selection. FHA fund try popular getting basic-go out home buyers, demanding the absolute minimum advance payment out-of step 3.5%. Va financing bring advantages to veterans and you can productive-responsibility armed forces team, including no advance payment. Traditional fund was another option, typically demanding a deposit of at least 20%. Search more mortgage pricing and mortgage terms to discover the best complement the money you owe.

Authorities Recommendations Applications

Regulators guidance applications into the Ca helps you money your own prefab family. These software aim to make family-ownership even more accessible and reasonable to own Californians. A few of the government advice solutions become advance payment advice programs, first-go out household client programs, and you will low-notice loan applications. These types of software also provide capital and incentives for those searching purchasing a prefab household.

Credit score and you will Monetary Thinking

Maintaining good credit is key when capital an effective prefab household. Lenders make use of your credit history to choose your own creditworthiness together with rate of interest your qualify for. A higher credit history often means down rates, saving you profit the near future. Before you apply for a financial loan, remark your credit score when it comes down to mistakes and you may work at improving the get when needed. Start with expenses costs punctually, remaining mastercard stability lowest, and you can to stop starting the newest borrowing accounts. Economic thinking involves rescuing having an advance payment, information your finances, and you may examining your general financial health.

Cost management to possess a Prefab Family

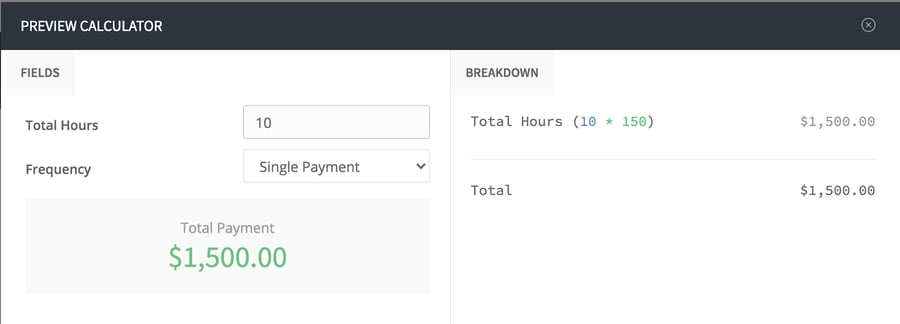

When budgeting to own a prefab house for the California, it is very important believe individuals can cost you like the real prices of your prefab house, people residential property will set you back, delivery and you will installations charges, foundation costs, it allows, electric contacts, and you will any extra alteration you can even include. To make sure you stand inside funds, it’s required locate estimates off numerous prefab house enterprises, reason for any potential upgrades otherwise customization’s, and you will meticulously opinion the latest conditions and terms for any hidden can cost you otherwise charges which can arise. Thought and you may evaluating carefully allows you to do an authentic finances to suit your prefab household investment and prevent one monetary surprises along the way in which.

Looking Loan providers and you can Financing Investigations

When looking for lenders to invest in their prefab family, begin by researching regional borrowing from the bank unions, banks, an internet-based loan providers you to definitely are experts in lenders. It is important to evaluate interest rates, loan terminology, and you will charge out-of some other lenders to find the best price. Consider these tips when you compare money:

- Rates of interest: See the lowest rates offered to save money more the life span of the financing.

- Loan Terms: Take note of the amount of the borrowed funds and you can when it even offers freedom for the repayment choice.

- Fees: Look for people origination charges, settlement costs, otherwise prepayment penalties which will enhance the cost of the brand new loan.

By the evaluating loan providers and you may mortgage selection, it is possible to make the best choice that suits your financial need and assists you safer capital for your prefab family during the California.

Legalities and you may Agreements

When you find yourself writing about legalities and agreements to suit your prefab house into the Ca, there are a few trick what you should remember. Make sure you very carefully discover and discover all the contracts before you sign all of them. Find legal services if needed to make certain you happen to be safe. Here’s a few off facts to consider:

- California have certain legislation governing prefab home, so familiarize yourself with these types of statutes.

- Comprehend the assurance facts available with the manufacturer and you may builder to end any unexpected situations subsequently.

Strategies for Successfully Resource The Prefab Family

When capital your prefab household, it is necessary to care for a good credit score. Lenders usually check your credit score to determine the loan eligibility. Prioritize preserving to have an advance payment so you can safer an even more favorable mortgage words. Research rates getting loan providers evaluate interest rates and you may mortgage choices. Thought providing pre-acknowledged for a financial loan to demonstrate sellers youre a significant client. Engage a representative who has got expertise in prefab land to greatly help browse the purchasing process smoothly.