Modify a primary quarters fixer-upper with good 203K restoration loan

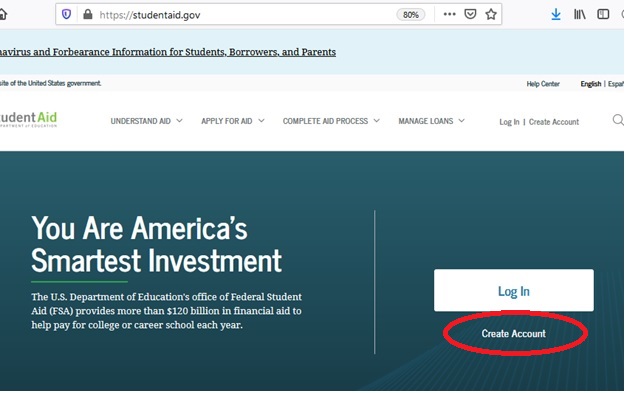

- Log on

- Spend My personal Financing

- Get a property

- Mortgage Versions

- Re-finance

- Mortgage Calculator

- Careers

Mann Financial try happy to help you mention our very own “Hopes and dreams having Beams” system, that gives consumers a far greater selection for res. When you incorporate a MannMade Recovery Financing, it is possible to get access to our very own collaborative, cloud-situated restoration mortgage software to manage the entire opportunity off initiate to end if you’re simplifying telecommunications ranging from you, this new builder, 3rd-cluster inspectors, and you can identity enterprises. We control your mortgage as well as the creator relationship into the-family, and you will focus on a loyal membership director regarding recovery procedure.

What are restoration financing?

A property restoration financing is a kind of mortgage made to loans both a buy otherwise recovery out of a great fixer-upper household. In place of antique mortgage loans, the brand new recovery loan’s interest is founded on the worth of the house shortly after restoration is done. Read more “Modify a primary quarters fixer-upper with good 203K restoration loan”