All you have to Know about To invest in a property That have Crappy Credit

In terms of mortgage loans for those who have a credit rating under 640, it is possible to begin to has fewer alternatives and get a lot fewer lenders ready to help you. But not, quicker does not always mean zero.

FHA Funds: FHA works together with consumers which have credit scores only 500. When you yourself have a get from five-hundred-579 you will need to place ten% off. For those who have an excellent 580 otherwise ideal you’ll want to lay step 3.5% off.

Va Funds: Virtual assistant financing are to possess effective responsibility and you can pros and do not want a deposit. Virtual assistant finance are very versatile, just like the Va does not have any at least credit history needs though really lenders wouldn’t go lower than just five-hundred. Some of the large package Va loan providers would not go under 640 otherwise 620. :

USDA Rural Innovation Fund: The latest outlying innovation loan is additionally a no down payment program however, many lenders need you to features a 640 credit rating or maybe more to help you qualify. Yet not, particular loan providers assists you to score good USDA loan with an excellent 580 credit score or maybe more.

One may purchase a home which have less than perfect credit, and it also commonly however is practical, however, there are a few what you want knowing.

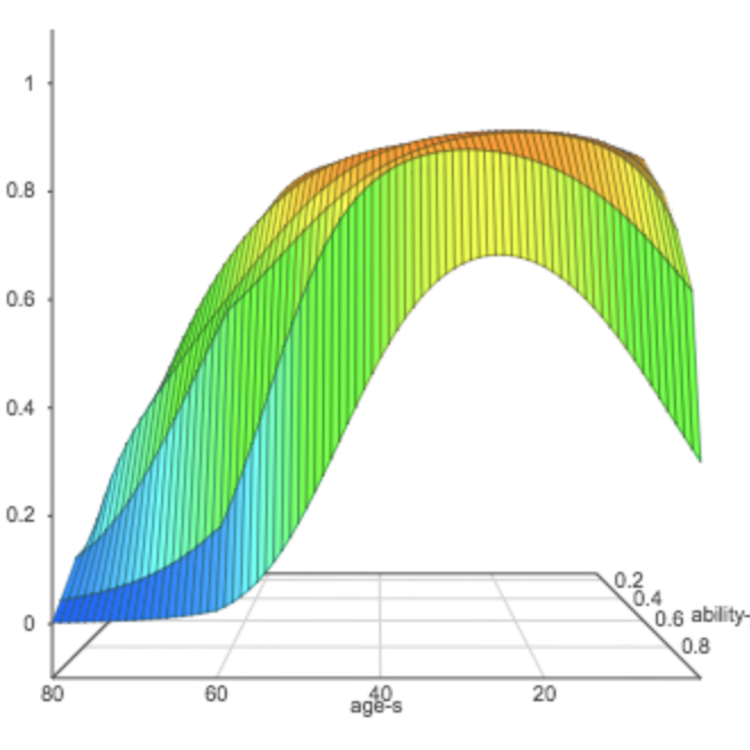

Poor credit Will cost you Much more

Purchasing a house is going to charge you more in the event the you had better credit. Also consumers which have countless 620 or more will pay reduced than others lower than 620. Read more “All you have to Know about To invest in a property That have Crappy Credit”