This means that, you can examine with your lending company to determine simply how much you will need to establish

In this post

- Serious Put

- Down-payment Matter

- Serious Put Number

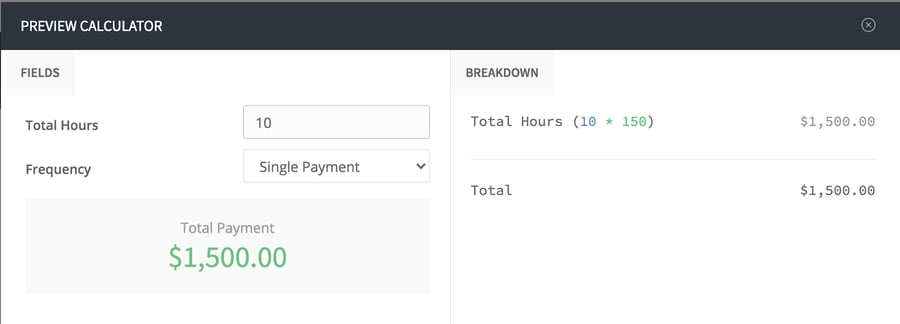

- Advance payment Fee

- Average advance payment

The advance payment into the another household can be no less than twenty %, although current alterations in financing has led to lower criteria. Typically, down-payment amounts enjoys ranged from ten so you’re able to twenty %. But with the fresh new financing models, the new rates is actually changing. Below, become familiar with just how much out-of a down-payment you’ll want to build.

Serious Put

The amount of earnest money you need to shell out to help you get a property may vary with regards to the price of the home and the seller’s standards. You could spend only a few hundred bucks otherwise up to several thousand dollars. Brand new serious currency count are different according to budget and you may industry conditions. To own qualities priced significantly below a hundred thousand cash, the new earnest currency number can often be lower than five hundred dollars. From inside the highest prices, brand new earnest cash is a lot higher in fact it is often called for.

An earnest money deposit is often one five per cent away from the cost. While you are discussing, you could potentially offer so much more. However, just remember that , if for example the exchange does not experience, the money in the escrow account will remain secured to possess good longer period of time. As an alternative, you could potentially spend earnest cash in one or more fees. Either way, make an effort to has actually an acknowledgment to show you provides reduced this new put.

In terms of earnest money, make sure to work with a reputable third-people, eg an attorney otherwise identity business. Read more “This means that, you can examine with your lending company to determine simply how much you will need to establish”