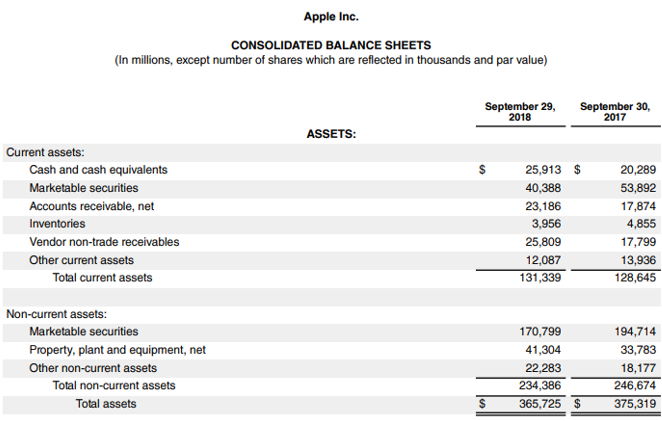

NAR helps you project how much cash is coming in and out, when you’ll have it on hand to pay wages, rent, and inventory – and other obligations. Accounts closing is the amount of outstanding receivables at the end of the day. Accounts opening is the amount of outstanding receivables at the start of the day. Make a habit of consistently recording any changes, which ensures the balance sheet remains a reliable tool for internal assessments or external presentations.

How to Calculate Net Accounts Receivable: Net Receivables Formula & Its Calculation

Let’s face it, accounts receivable management can be such a drag when trying to pursue it manually across several platforms. That’s where Synder comes in, helping automate and simplify your accounts receivable processes. The aging schedule may calculate the uncollectible receivables by applying various default rates to each outstanding date range. Companies use net receivables to measure the effectiveness of their collections process. They also utilize it when making forecasts to project anticipated cash inflows. Conversely, a well-managed AR showcases a business that’s adept at balancing customer relationships with robust financial health.

Average Accounts Receivable

First, let’s provide a brief overview of the significance of this financial figure. Conversely, a low AR might seem positive, but if it’s combined with declining sales, there’s a bigger issue at hand. These are the most common AR formulas you’ll need to know how to use in your business. Also, a specific identification method may be used in which each debt is individually evaluated regarding the likelihood of being collected.

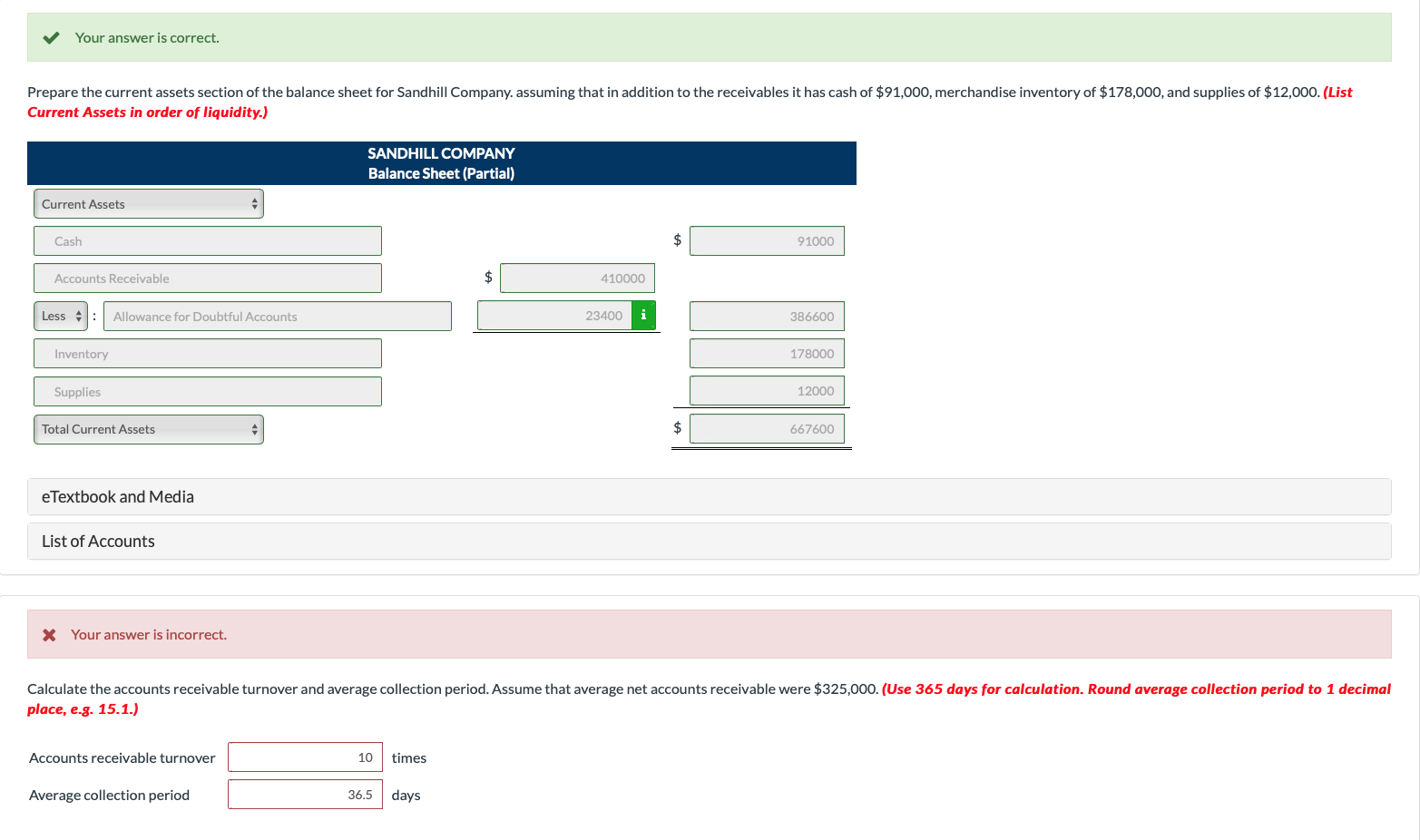

Example of Receivables Turnover Ratio

Net credit sales is the revenue generated when a firm sells its goods or services on credit on a given day – the product is sold, but the money will be paid later. To keep track of the cash flow (movement of money), this has to be recorded in the accounting books (bookkeeping is an integral part of healthy business activity). This legal claim that the customers will pay for the product, is called accounts receivables, and related factor describing its efficiency is called the receivables turnover ratio.

How to Calculate Average Net Receivables

- Calculating the average collection period with average accounts receivable and total credit sales.

- The average net receivables metric is often used in conjunction with the accounts receivable turnover ratio to assess the efficiency of a company’s credit and collection policies.

- It shines a light on the efficiency of your collections process, which is vital for cash flow management.

Learning how to calculate cash collections from accounts receivable reveals the amount of cash collected from customers within a period. It shines a light on the efficiency of your collections process, which is vital for cash flow management. We’ll demystify a myriad of different formulas and ratios you need to know – from how to calculate accounts receivable turnover ratio to how to calculate net accounts receivable. average net receivables You’ll even learn what to do with this figure once you find it, and how you can automate AR for good and never even think about it again. Net receivables are the total money owed to a company by its customers minus the money owed that will likely never be paid. Net receivables are often expressed as a percentage, and a higher percentage indicates a business has a greater ability to collect from its customers.

What Is a Good Accounts Receivable Turnover Ratio?

The net receivables figure is not entirely accurate, since it includes an estimate of possible bad debts – which may turn out to be different from the estimate. This means that Primo collects nearly their entire AR balance at least eight times per year and that it is taking about one-and-a-half months or about 45 days after a sale is made to collect the cash. Not only is this important information for creditors, but it also helps the business more accurately plan its cash flow needs. It also allows the business to examine whether or not their credit policies are too restrictive or too generous. The receivables turnover ratio calculator is a simple tool that helps you calculate the accounts receivable turnover ratio.

As such, the beginning and ending values selected when calculating the average accounts receivable should be carefully chosen to accurately reflect the company’s performance. Investors could take an average of accounts receivable from each month during a 12-month period to help smooth out any seasonal gaps. Continuously monitoring average accounts receivable and related ratios allows you to measure progress. Over time, an optimized approach can significantly improve working capital management.

Otherwise, it’s time to take control of your AR management process with a hands-off approach at InvoiceSherpa. High AR might indicate sluggish collection processes, signaling potential inefficiencies or even deeper financial challenges. Without a precise handle on AR, a business may find itself unable to meet immediate financial obligations, from salaries to overhead costs.

Laura has worked in a wide variety of industries throughout her working life, including retail sales, logistics, merchandising, food service quick-serve and casual dining, janitorial, and more. This experience has given her a great deal of insight to pull from when writing about business topics. As long as you get paid or pay in cash, sure, the act of buying or selling is immediately followed by payment. Businesses leveraging InvoiceSherpa see a 25% reduction in past-due receivables and a 15% decrease in bad debt reserves.

In business, that outstanding money is called accounts receivable, and managing it effectively is the key to healthy cash flow. This isn’t just about chasing late payments; it’s about understanding exactly what money you’re owed and when you can expect it. Average net receivables is the multi-period average of accounts receivable ending balances, netted against the average allowance for doubtful accounts for the same periods. The concept is used in a number of liquidity ratios (especially the accounts receivable turnover ratio). It is intended to smooth out any unusual spikes or drops in the ending receivables balance in the current period.

Regardless of the entity’s procedures, the figure tends to worsen as financial conditions worsen in the general economy. Alternatively, it can simply calculate the net receivables by applying the estimated collection rate for each range. The concept behind an aging schedule is to apply different collectibility rates to different receivables based on age. You still get your product, but the payment is deferred – meaning it is put off to a later time. We’re here to help simplify things for you with this guide on how to create an accounting system for a small business.